straight life annuity death benefit

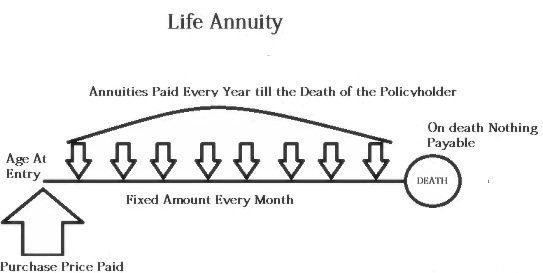

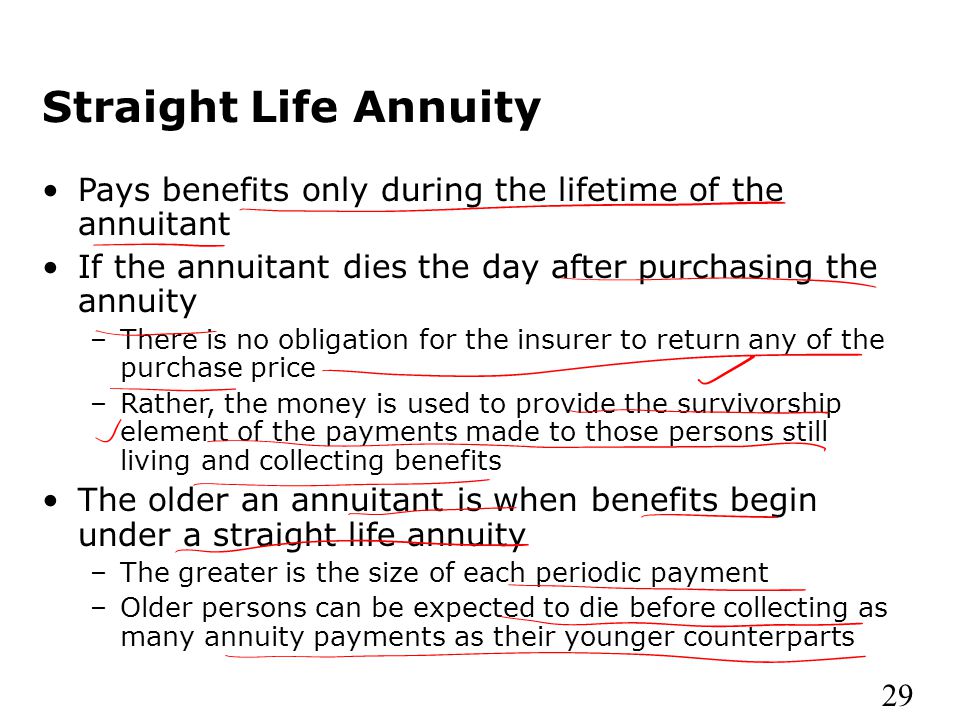

A straight life annuity is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or a death benefit. The straight life annuity choice gives the retiree an income he cannot outlive.

A straight life annuity is an insurance product that provides guaranteed retirement income for life.

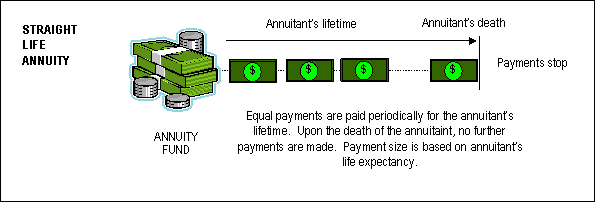

. During retirement annuitants receive an income that is guaranteed to last throughout. By Olivia Faucher. A straight life annuity is an annuity that pays a guaranteed stream of income but ceases payments upon the death of the annuity holder.

Because the payouts will be shorter in duration they offer the highest periodic payments. A straight life annuity will guarantee you a stream of payments for the rest of your life but those payments will stop when you die. Under a straight life annuity contract the annuity makes payouts on a regular basis for the remainder of the annuitants life no matter how long the.

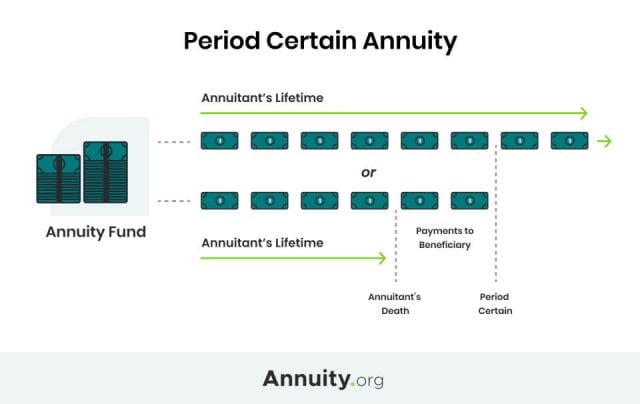

Straight life annuities do not include a death benefit so payments cant be made to a beneficiary. Straight life annuities dont offer beneficiary. This money can be used for anything including covering final expenses paying.

A Straight Life Annuity Retirement Plan also known as Straight Life Policy or Single Life Annuity is a retirement income product that pays a benefit until death but forgoes any. They provide income during an annuitants retirement and it is guaranteed to last the. Which is best if I have a family.

In most cases there is no death benefit or. Define Single straight life annuity or maximum benefit. The Straight Life Option.

A straight life annuity will guarantee you a stream of payments throughout your life but those payments end upon death. A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or a death benefit. Means an annuity for the lifetime of the member only which has not been reduced to provide a lifetime monthly benefit to a spouse or.

When you die the death benefit from a straight life insurance policy is paid out to your beneficiaries. With the life expectancy of retirees continuing to lengthen having a guaranteed life income provides a. Unlike permanent life insurance straight life annuities dont offer a death.

On the death of the. The straight life option pays a monthly annuity directly to the retiree for life. There is no beneficiary.

There is typically no death benefit or continued. Straight life is the simplest benefit option offered by APERS. Because straight life annuities dont offer a death benefit they are usually less expensive than straight life insurance policies.

Annuity Payout Options Immediate Vs Deferred Annuities

What Is A Straight Life Annuity Everything You Need To Know

Period Certain Annuity What It Is Benefits And Drawbacks

Annuities And Individual Retirement Accounts Ppt Video Online Download

What Is A Straight Life Annuity Everything You Need To Know

Straight Life Annuity For Retirement Is It Right For You Paradigm Life

Straight Life Annuity Discover How It Works What You Need To Know Wealth Nation

New York Life Annuity Immediate Annuity

What Is A Straight Life Annuity Retirement Watch

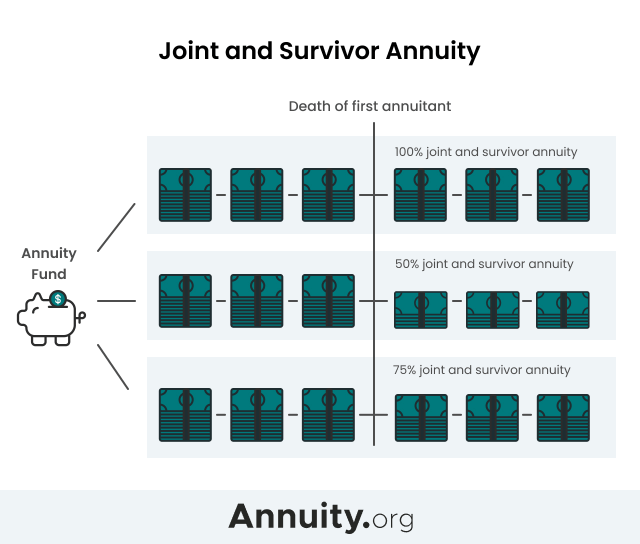

Joint And Survivor Annuity The Benefits And Disadvantages

Straight Life Annuity Discover How It Works What You Need To Know Wealth Nation

Is A Straight Life Policy Right For Me Paradigmlife Net Blog

Straight Life Annuity Discover How It Works What You Need To Know Wealth Nation

Straight Life Annuity Providing Peace Of Mind In Your Retirement

Straight Life Annuity For Retirement Is It Right For You Paradigm Life